REPLAN

A Robust Solution to Life Insurance

- Persistency Ratio

- Value of New Business (VNB)

- Surrender Ratio

- Product Mix

- Channel Mix

150+

Consultants

30+

Projects Completed

15+

Industries Served

Our Achievements

150+

Consultants

30+

Projects Completed

15+

Industries Served

Our Achievements

REPLAN for Life Insurance

The only planning solution you need for operational and financial planning for your insurance business. Replan comes with intuitive UX and a robust structure for easy adaptation and business success.

Features

Interactive Features of REPLAN

AUM (Assets Under Management)

This refers to the total value of all the investments held by an insurance company on behalf of its policyholders. These investments can include stocks, bonds, real estate, and other assets. The FP&A team monitors the AUM to ensure it grows over time, generating returns that contribute to the company's profitability and help cover future policyholder benefits.

NPB (New Business Premium)

This is the total amount of premium collected from new life insurance policies sold in a particular period. NBP is a crucial growth metric for insurance companies, as it represents the inflow of fresh capital. The FP&A team looks to maximize NBP through strategic marketing and product development initiatives.

APE (Annualized Premium Equivalent)

This is a metric that converts single premiums (paid upfront for a policy) into an equivalent stream of annual premiums. It allows for a more standardized comparison of new business production across different policy types (single premium vs. regular premium payments). The FP&A team uses APE to assess the overall value of new business generated and project future premium income.

Death Benefit

This is the core payout of a life insurance policy. It's the lump sum of money paid to the beneficiary upon the policyholder's death. The amount of the death benefit is determined by the policy terms, typically a multiple of the premiums paid. The FP&A team meticulously calculates death benefits based on mortality rates to ensure the company has adequate reserves to meet future claims.

Pension Benefits

Some life insurance policies, particularly whole life and endowment plans, can accumulate cash value over time. This cash value can be used to provide retirement income through annuity payouts or withdrawals. The FP&A team considers factors like interest rates and life expectancy when designing these plans to ensure they meet future income needs of policyholders.

Unit Linked Plans (ULIPs)

These are investment-linked insurance plans where a portion of the premium is invested in market-linked funds. The policyholder benefits from potential investment growth, but also shares the associated risk. The FP&A team carefully manages the investment options offered in ULIPs to balance risk and return for policyholders.

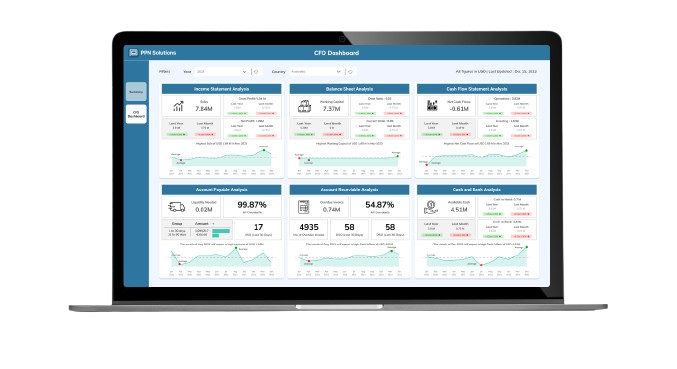

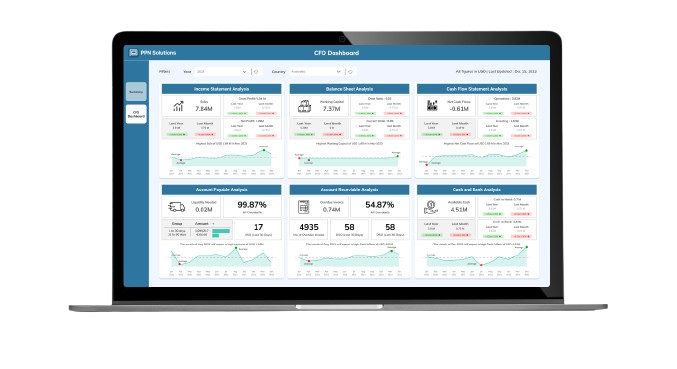

REPLAN - Your Insurance Business with Ease

The persistency ratio in life insurance is a key metric that reflects the percentage of policyholders who continue paying premiums on their policies beyond the initial term. It essentially measures customer retention and the overall health of an insurance company’s in-force business. A high persistency ratio indicates that a high proportion of policyholders are renewing their policies and continuing their coverage. This translates to a stable income stream for the insurer and a more predictable business model.

Value of New Business (VNB) is a crucial metric used in life insurance to assess the profitability of new policies written during a specific period (usually a year). It essentially estimates the present value of all future profits expected from these new policies. It involves actuarial assumptions and takes into account several factors like premiums, benefits, expenses and discount rates.

The surrender ratio is the percentage of policies that are surrendered (cancelled) by policyholders before their maturity date. A high surrender ratio indicates that a significant portion of policyholders are dropping their coverage early. Unfair business practices by insurance companies can contribute to a high surrender ratio. Productivity ratio is a metric used in the life insurance industry to assess an agent or agency’s productivity and contribution to a company’s overall new business performance.

Product mix refers to the variety of life insurance policies offered by a company. It encompasses the different types of coverage available, each catering to specific needs and financial goals of policyholders. A well-designed product mix offers something for everyone and helps an insurance company reach a broader audience.

Channel mix in life insurance refers to the various distribution channels used by insurance companies to reach potential customers and sell their products. A strategic channel mix leverages the strengths of different channels to optimize sales and reach a wider audience.

Benefits

Key Benefits of REPLAN

The current business landscape is full of complexities and obstacles that hinder growth. Therefore it’s crucial to address these challenges head-on to ensure business success.

- Reduce Time of Implementation

- Best Practices will be part of the Solution

- Fully Configurable as per Customer requirement

- Fully Integrated with Core FP&A Platform

- Pre-configured Scalable solution

Our Expertise

Industry Specific Blueprints

Strike the perfect balance between capacity, pricing, and overheads to ensure the project's profitability.

Implement Board to improve risk management &pave the way for effective budgeting, planning, and forecasting.

Streamline production, manage inventory, optimize supply chain, and reduce overall cost with smart Board Solutions.

Get smart grid analysis with energy forecasting & tailored recommendations for optimized operation.

Improve performance through actionable insights & drive profitability through cost & portfolio management.

Maximize profitability through advanced strategies using a customized scorecard and dashboard for KPI tracking.

Why Choose Us?

Few reasons for people choosing PPN Solutions

From SAP, Zoho, and Board implementation to web development, staffing needs and digital marketing, we can help you with whatever your business needs to stand out in the market.

REPLAN

Prebuilt Industry Specific Accelerator

Support and Training

Manage Services

Collaborative DNA

Successful Project Delivery

Passionate Team

Innovative and Complimentary Technologies

FAQ

Frequently Asked Questions

Let us illuminate the path forward with a proven track record, unparalleled expertise, and a commitment to turning your financial aspirations into triumphant realities. What sets us apart is not just our proficiency, but the promise of a transformative experience that propels your financial landscape into a realm of unprecedented success. So, why settle for the ordinary when the extraordinary awaits? Choose us, and let's embark on a journey where financial transformation meets unparalleled excellence.

Assessing readiness for transformative FP&A solutions involves monitoring milestones like data complexity, performance bottlenecks, strategic expansion, and signals such as increased collaboration needs and real-time insights demand. Evaluating these indicators guides informed investment decisions.

Our Insights

Blog & News Update

Contact Us

Time To Make Your Insurance Business Smarter

Effective planning is crucial for any business and the insurance industry is no different. With valuable information in hand, you can get insights into your financial performance and make better business decisions. Using spreadsheet-based planning is not only time-consuming but also prone to errors.

REPLAN can help you digitize multiple aspects of planning required in the insurance industry including project planning, revenue planning, lease planning, and much more.

Moreover, it enables you to create detailed plans that account for various scenarios and keep your business remains profitable and resilient to changing market conditions.

Don’t let uncertainty hold your business back – Take the first step by scheduling a demo.

Contact us

Fill in the details!