Automate & Digitize Insurance Contracts with

IFRS 17

- Define Assumptions at the Cohort Level

- Define Force Policy at the Cohort Level

- Assume Discount and Risk Factors

- Streamline Cost Allocation

- Better Cash Flow Generation

150+

Consultants

30+

Projects Completed

15+

Industries Served

Our Achievements

150+

Consultants

30+

Projects Completed

15+

Industries Served

Our Achievements

Financial Reporting with IFRS 17

IFRS 17 is a new International Financial Reporting Standard that replaces IFRS 4 on accounting for insurance contracts. Our objective is to automate and digitalize the application of IFRS 17 for life insurance contracts, making it easier for insurance companies to generate cash flows.

Implementing IFRS 17 can be a complex and time-consuming task, especially when it comes to calculating cash flows. That’s why we offer a comprehensive solution that takes care of all your IFRS 17 needs.

Features

Some Out-of-the-Box Features

Complete View of Policy

Policy premiums can be viewed based on various criteria, including age brackets, payment frequency (quarterly, half-yearly, annually, single, or monthly), and customer ratings using interactive charts.

Accurate Risk Benefits Calculation

Risk benefits are calculated using a sophisticated algorithm that takes into account four key factors: Risk percentage, Risk multiplier, Risk benefit (as a percentage of premium), and Risk compound interest.

Better Prediction of Cash Outflows

Cash outflows involve calculating maturity benefits using analyzed factors and maturity values at various frequency levels to ensure accurate calculations and informed decision-making.

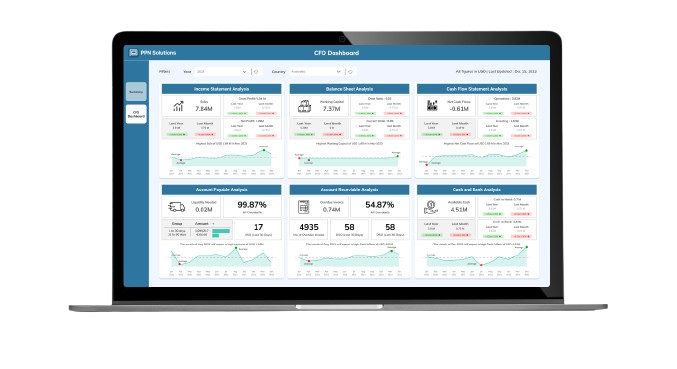

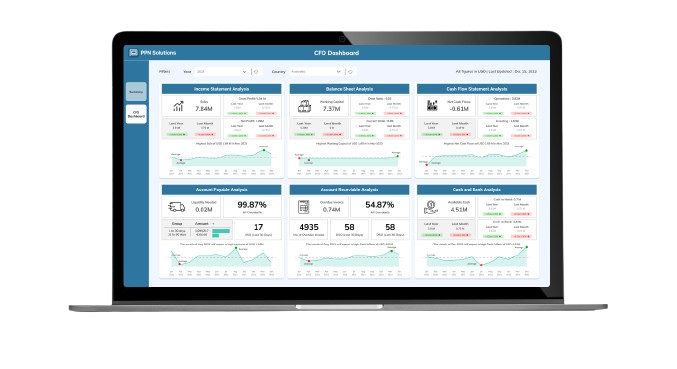

Improved Reporting

Cash flow reports are thoroughly prepared, including detailed and summary versions, both before and after considering probability. Additionally, discounted and risk-adjusted cash flows are reported to provide a complete picture of the financial situation.

Intuitive User Experience

An intuitive user experience using a seamless, user-friendly interface that simplifies complex reporting processes, minimizes errors and increases efficiency.

Analyze Expenses

Expenses can be viewed at various levels within the organization, including by cost center, cohort, and policy ID. This allows for detailed monitoring and analysis of expenses across different departments, projects, or teams, as well as tracking of expenses over time.

IFRS - Manage Your Insurance Contracts Like Never Before!

These assumptions might include things like the expected claims frequency and severity, policyholder behavior, and investment returns, which can all have a significant impact on the profitability and solvency of the insurer.

Insurers can better manage and report on their insurance contracts, taking into account the unique features and risks associated with each group of contracts for greater flexibility and accuracy in financial reporting.

Help in estimating the present value of future cash flows and calculating the liabilities associated with their insurance contracts for accurately reporting financial position and performance.

A centralized platform for capturing, tracking, and reporting on all relevant costs, allowing you to easily allocate costs to different contracts, policies, and business lines, accurately and consistently.

Benefits

Key Benefits of REPLAN

The current business landscape is full of complexities and obstacles that hinder growth. Therefore it’s crucial to address these challenges head-on to ensure business success.

- Reduced Complexity for Insurance Contracts

- Increased Confidence in Financial Reporting

- Premium Allocation Approach

- Improved Risk Management

- Increased Transparency and Disclosure

Our Expertise

Industry Specific Blueprints

Strike the perfect balance between capacity, pricing, and overheads to ensure the project's profitability.

Implement Board to improve risk management &pave the way for effective budgeting, planning, and forecasting.

Streamline production, manage inventory, optimize supply chain, and reduce overall cost with smart Board Solutions.

Get smart grid analysis with energy forecasting & tailored recommendations for optimized operation.

Improve performance through actionable insights & drive profitability through cost & portfolio management.

Maximize profitability through advanced strategies using a customized scorecard and dashboard for KPI tracking.

Why Choose Us?

Few reasons for people choosing PPN Solutions

From SAP, Zoho, and Board implementation to web development, staffing needs and digital marketing, we can help you with whatever your business needs to stand out in the market.

REPLAN

Prebuilt Industry Specific Accelerator

Support and Training

Manage Services

Collaborative DNA

Successful Project Delivery

Passionate Team

Innovative and Complimentary Technologies

FAQ

Frequently Asked Questions

Let us illuminate the path forward with a proven track record, unparalleled expertise, and a commitment to turning your financial aspirations into triumphant realities. What sets us apart is not just our proficiency, but the promise of a transformative experience that propels your financial landscape into a realm of unprecedented success. So, why settle for the ordinary when the extraordinary awaits? Choose us, and let's embark on a journey where financial transformation meets unparalleled excellence.

Assessing readiness for transformative FP&A solutions involves monitoring milestones like data complexity, performance bottlenecks, strategic expansion, and signals such as increased collaboration needs and real-time insights demand. Evaluating these indicators guides informed investment decisions.

Our Insights

Blog & News Update

Contact Us

Improve Financial reporting with IFRS 17

IFRS 17 is designed to simplify complex financial reporting processes. It introduces a new approach to accounting for insurance contracts, making it easier for companies to provide transparent and comparable information to stakeholders. With improved data quality and better decision-making capabilities, businesses can make more informed choices and stay ahead of the competition.

Our intuitive interface allows you to input actuarial assumptions for different product categories, discount factors, risk factors, and more in just a few clicks. You can also define an allocation matrix based on factors such as cost center, allocation driver, and cohort level.

By leveraging the power of IFRS 17, you can make use of data for better decisions that drive profitability by identifying areas of improvement, optimizing resources, and allocating funds effectively.

Try IFRS 17 today and experience the difference for yourself.

Contact us

Fill in the details!