Still relying on an annual budget to guide your business while the market moves at lightning speed?

If so, you’re not alone—but you might be at a disadvantage.

Budgets set the direction. Rolling forecasts keep your plans alive.

Many organizations still use a traditional budgeting approach: lock in numbers once a year, and stick with them no matter what. It’s like trying to navigate with last year’s map in a city that’s constantly changing.

But in today’s volatile, fast-moving environment, businesses need more than a static plan. They need agility—and that’s exactly what rolling forecasting delivers.

What Is Rolling Forecasting?

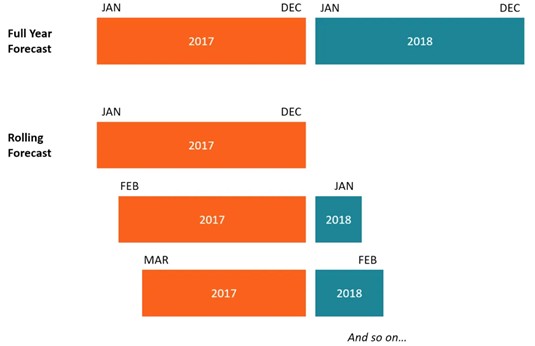

Rolling forecasting is a dynamic financial planning method that continuously updates your forecast based on real-time data and current market conditions. Rather than building a plan once a year and hoping for the best, rolling forecasts maintain a 12–18 month forward-looking view, refreshing at regular intervals (monthly or quarterly).

This means you’re always looking ahead—not behind.

Where a traditional budget becomes outdated shortly after it’s finalized, rolling forecasting evolves with your business. It’s proactive, not reactive.

Budget vs. Rolling Forecast: What’s the Real Difference?

| Feature | Annual Budget | Rolling Forecast |

| Frequency | Once a year | Monthly or quarterly |

| Time horizon | Fixed fiscal year | Continuously moves forward |

| Flexibility | Low | High |

| Data source | Historical, static | Real-time, dynamic |

| Responsiveness to change | Poor | Excellent |

5 Reasons Rolling Forecasting Outshines Traditional Budgeting

1. Agility to Adapt

The biggest strength of rolling forecasting is its ability to respond to change. If your market shifts, your forecast shifts with it—no need to wait for the next annual budget cycle.

This helps businesses stay aligned with reality, not assumptions.

2. Increased Efficiency

Traditional budgeting is often a months-long process involving countless meetings and revisions. Rolling forecasts are lighter and quicker. Instead of rebuilding everything from scratch, you simply update your existing forecast using the latest data.

This saves time, reduces manual effort, and frees up teams to focus on value-adding activities.

3. Greater Accuracy

Since rolling forecasts are based on current data rather than outdated projections, decision-makers gain a clearer picture of what’s really happening. This means fewer surprises and more informed choices.

4. Smarter Resource Allocation

Rolling forecasts allow you to reallocate resources based on emerging priorities. Rather than being locked into decisions made a year ago, you can direct funding and people where they’ll make the biggest impact right now.

5. Future-Focused Strategy

While budgets often focus on meeting last year’s targets, rolling forecasts are inherently forward-thinking. They keep your business focused on what’s coming—so you’re always planning, not just reporting.

How EPM Tools Take Rolling Forecasts Even Further

Modern Enterprise Performance Management (EPM) platforms supercharge rolling forecasting with automation and advanced analytics.

Key features include:

- 🔄 Real-time data integration from ERP, CRM, and HR systems

- 📊 Driver-based models that simulate “what-if” scenarios

- 📆 Automatic rolling time horizon (12–18 months forward)

- ⏱ Faster turnaround cycles, from weeks to days

With the right tools in place, you can transform forecasting from a reactive task into a strategic capability.

Conclusion: From Maps to GPS

Traditional budgets aren’t going away—but they’re no longer enough. They serve as a foundation, but they can’t provide the adaptability today’s business environment demands.

Rolling forecasts don’t replace budgets—they make them smarter.

Think of it this way: budgets are the map, but rolling forecasts are your GPS—always recalculating, always showing the best route forward.

If your organization is ready to move from static planning to agile forecasting, now is the time to make the shift.

Supriya Gupta

Principal Consultant - Financial Transformation